Fashion environmental waste, the secondhand market, and the impact of tariffs within the fashion industry are interconnected issues that warrant closer examination. The industry is one of the largest contributors to environmental degradation, generating massive amounts of waste through production and disposal of clothing.

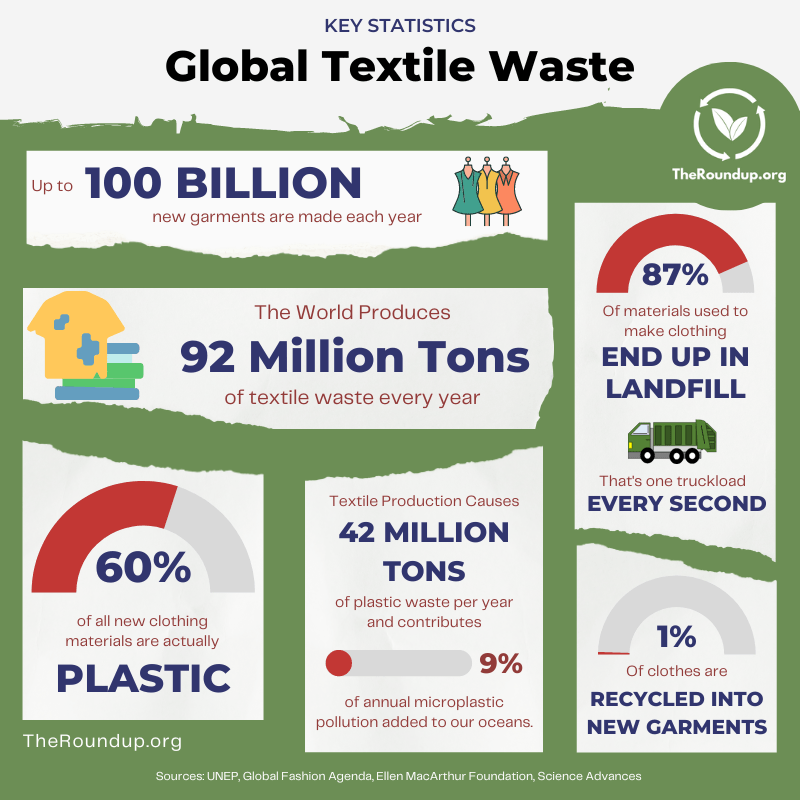

According to Roundup.org, data sourced from UNEP, Global Fashion Agenda, Science Advances, and the Ellen MacArthur Foundation, between 80 and 100 billion new clothing garments are produced globally annually. 87% of the materials and fibers used to make clothing will end up in either incinerators or landfills. 92 million tons of textile waste are generated each year, of which China (20M tons) and the US (17M tons) produce the most. Only 20% of discarded textiles are collected, and only 1% of clothes will get recycled into new garments.

Did you know Kamikatsu-cho, Tokushima Prefecture, Japan is a zero-waste town deep in the Japanese mountains renowned for its innovative approach to sustainability, with a recycling rate that exceeds 80%?

A model community where waste is not an option.

Consumers hold the power to significantly reduce textile waste, yet our fashion consumption habits often lead us to buy clothes merely to throw them away! The fashion industry is plagued by excessive over-consumption, driven by a culture of speed and disposability—fast fashion.

As consumers wake up to this harsh reality, the secondhand market has exploded as a sustainable alternative, offering a lifeline to reduce waste and promote a circular economy. The recent onslaught of tariffs on imported clothing and shoes has also given a boost to the secondhand market, with higher costs provoking a shift in shopping habits, pushing price-conscious consumers to scour local thrift shops and online resale platforms for better deals. The US Chamber of Commerce reports that the Federal government, in May and June, imposed $1.9 Billion in additional taxes in clothing and shoes, exceeding 25% on average tariff tax rate compared to 14% a year ago. Reuters reveals that US prices of fast-fashion brand Zara was up by 28% in the month of June from a year ago, due to tariffs. With growing environmental concerns, the rise of the secondhand market and the impact of tariffs are simply urging both consumers and retailers to rethink their buying habits and commit to sustainability.

Let’s examine the critical data points relevant to the clothing and textile industry, focusing on trends within the secondhand market, consumer survey findings regarding perceptions of secondhand shopping, as well as discussions surrounding tariffs on fashion, governmental policies regarding waste, and the influence of artificial intelligence in the current fashion landscape.

The Clothing and Textile Industry Today

$2.4 trillion

Contributes $2.4 trillion to the approximate $16 trillion global manufacturing yearly output

300 million

Employs 300 million people worldwide across the value chain (many of them women)

215 trillion

Around 215 trillion liters of water per year are consumed by the industry

$100 billion

Annual material loss of US $100 billion due to underutilization

2-8% CO2

Is responsible for an estimated 2-8% of the world’s greenhouse gas emissions

9%

Textiles account for approximately 9% of annual microplastic losses to the oceans

Secondhand Clothing, Tariffs, and AI

According to ThredUp’s annual 2025 (U.S.) Resale Market and Consumer Trend Report, 58% of consumers bought secondhand clothing in 2024, a record high that is up 6% from 2023. The secondhand apparel market now represents 9% of global apparel sales and continues to take market share from traditional retail. ThredUp anticipates sales will hit $367 billion by 2029. Their 2025 report highlights these trends and looks at other factors like tariffs, artificial intelligence, and government support that are influencing this shift in the fashion retail market.

$367 Billion

Global Secondhand Apparel Market to Reach $367 Billion by 2029, Growing 2.7X Faster Than Overall Global Apparel Market.1

Tariffs

86% of retail executives expect new government policies around tariffs and trade to disrupt their global supply chain.1

Tariffs

59% of consumers [66% of younger generations] say if new government policies around tariffs and trade make apparel more expensive, they will seek more affordable options like secondhand.1

AI Support

AI is becoming a shopping tool for overwhelmed consumers, particularly online shoppers. 49% of consumers [60% younger generation] say if they could find current trends secondhand as easily as new, they’d buy more secondhand.1

AI Support

78% of retail executives have already made investments in AI. 62% of retail executives agree that AI has the power to make the secondhand shopping experience more appealing.1

Government Support

44% of retail executives believe the federal government should put forth a federal waste policy to make it easier for brands to manage textile waste.1

Government Support

72% of retail executives are seeking new ways to extend the life cycle of garments through programs like resale, upcycling, and repair. Of those, 36% are doing this in response to new regulation around managing textile waste.1

Consumer Protection

65% of consumers say the government should implement policies that protect consumers from deceptive marketing practices related to the environmental and social sustainability of apparel.1

Notes, Reports, Suggested Further Study

- 1ThredUp | Resale Report 2025

- United Nations Environment Programme | Sustainable Fashion Strategy Report, 2021-2024

- UNCCD-Fashion & Land: Unravelling the Environmental Impact of Fibres, Xenya Scanlon, United Nations Convention to Combat Desertification, 2024

- Future of FASHION? Secondhand. WASTE and Ownership REDIRECTED, EDGExpo.com

feature photo credit: Bale of discarded jeans. | photo: Alexander Donka, Renewcell. Renewcell is a Swedish recycling textile company.